LAND FOR SALE

OIL AND GAS NEWS, WEST TEXAS PERMIAN BASIN PRICING

And eight of the top fifteen counites for wells with first production within the last 12 months are in the Permian. The only category in which this region does not figure prominently is leasing, it boasts only four of the top fifteen counties for lease filings within the last six months, with most of these on the edges of the play.

KEY POINTS

- Activity in the Permian is high by all measures except new lease filing.

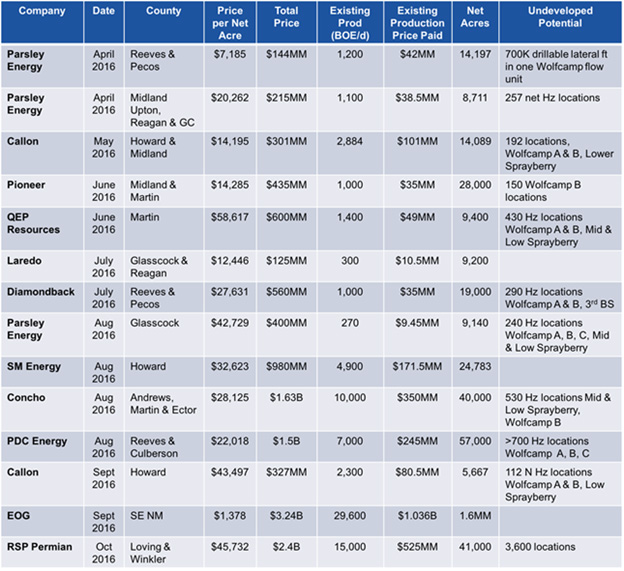

- Asset transactions (sales) involving Permian acreage ranged from $10,00 to $58,000 per net acre in 2016.

- Analysis of Wolfcamp B type curve production for recent long lateral wells in Martin County suggests land NPV from $52,000 to $269,000 per acre at $30 and $80 per barrel, respectively.

- NPV and acreage valuation estimates are sensitive to the decline curve model used to forecast production.

- Pioneer Wolfcamp B wells drilled in Martin County have a breakeven oil price of $21.40 per barrel, including land acquisition costs. Specify that this is for the new acreage.

- Because of more expensive land acquisition costs, the breakeven oil price for QEP in Martin County would be $31.50 per barrel.

The second and third quarters of 2016 have seen more than a dozen significant asset transactions involving Permian acreage with large deals being announced weekly. Most of the announcements highlight acreage that is held by production (HBP). The upside of HBP acreage for buyers is that they don’t have to develop the acreage quickly to maintain access, but it also puts upwards pressure on the price paid per acre. Buyers are forced to negotiate with other operators who often have a better idea of what the acreage (mineral holdings) are worth.

Because of the high potential production of Permian reservoirs like the Wolfcamp (oil zone) and the business-to-business nature of acreage transactions, the price paid per acre this year has ranged from $7,000 to $58,000 per a net mineral acre. The highest price paid so far was by QEP resources, who paid more than $58,000 per net undeveloped acre for core Midland Basin (includes your Howard, Martin, and Eddy County holdings with your Ward being on the eastern edge) acreage. That price has raised eyebrows and left many wondering how much e acreage is actually worth and concern about how high prices can go up. See Table 1 reflecting recent large sales of assets in the key counties.

Note: [Table 1 – Recent Permian acreage transactions (includes mergers and acquisitions). Only Concho ($50,000) and PDC ($35,000) disclosed the price paid per flowing barrel. $35,000 was used when the price was not disclosed. EOG details include acreage acquired outside the Delaware Basin.]

Although the desire to acquire Permian assets is unlikely to end soon given the favorable economics of the region and recent low oil prices, the ability for companies without deep pockets or wealthy investors to move into this area remains limited. However, if oil prices remain low we should see companies sell less profitable, non-Permian assets to finance Permian acquisitions. This will likely keep Permian sales prices breaking records until we see an oil price recovery.